The four primary ways to work with vision insurance

Having a direct relationship with vision plans can be an effective way to attract patients, but it comes with costs and benefits that need to be weighed carefully. Keeping in mind that these costs and benefits are subject to change over time in a number of different ways, so your participation as an in-network, out-of-network, opt-out, or Open Access provider is something that should be evaluated on at least an annual basis.

The best case scenario: benefits of being in-network with vision plans

Attracting New Patients

Being in-network with vision plans can help attract new patients to your practice. Many people who have vision insurance look for providers that are in-network with their plan; by accepting these plans directly, you can potentially tap into a larger pool of potential patients.

Increased Top Line Revenue

Along with increasing patient volume, participating in vision plans can also help increase your revenue. Although vision plans typically reimburse providers at a lower rate than private pay patients, the volume of patients can make up for the lower reimbursement rate.

Consider how long your practice has been around when thinking about this: if you're a brand new practice, vision insurances can be a great partner to grow your patient base.

Patient Loyalty

By accepting vision plans, you can build patient loyalty. Patients who have insurance may be more likely to return to your practice if they know that you accept their insurance. This can help build a steady base of patients and increase your revenue over time.

Some drawbacks of being in-network with vision insurances

Lower Reimbursement Rates

In addition to promising a lower out of pocket price for the patient, vision plans typically reimburse providers at a lower revenue than private pay patients would generate. This can have a significant impact your bottom line, especially when you rely heavily on vision insurance reimbursements.

Also, keep in mind that vision plans have not increased their reimbursement rates in decades, expecting you to do more work than ever, for less relative reimbursement than ever.

Administrative Burden

You'll need to keep up with the requirements of each plan, submit claims, and manage billing and payments. This can be time-consuming and take away from patient care. Especially when you consider that due to the low reimbursements, you will likely have to see more patients per day to be profitable than you would with a more balanced patient base.

When you have to see more patients, you have to hire more staff to accommodate, keeping your margins razor thin as you work harder and harder.

Limited Treatment Options

Most vision insurances limit the treatments and services that you can offer to patients as part of their covered, routine eye exam. This can be frustrating, not just for you as the practitioner, but for the patient as well: you and your patient both want you to provide the best care possible, but you are contractually limited by the vision plan’s rules and restrictions.

Think about products like Neurolens or high end sunglasses like Maui Jim that some vision insurances simply will not let you process.

Limited Control Over Pricing

When you sign your agreement with a vision insurance, you're agreeing to let that vision plan tell you how much your products and services are worth. You'll need to accept the reimbursement rates set by the insurance company, nevermind that these prices are way lower than what you would normally charge.

Because vision insurances say you can't price things differently for patients based on their payment method, this not only impacts your profitability with vision plan patients, it also make it much more difficult to offer competitive pricing to patients who don't have insurance.

You will have likely increased your usual & customary fees across the board to ensure you're receiving your full reimbursement from the vision plans you accept. Think about how these higher retail prices impact your capture rate and your new patient volume.

Patient Loyalty

Vision plans will say that by accepting vision plans, you can build patient loyalty. It’s true that patients who have vision insurance may be more likely to return to your practice if they know that you accept their insurance. While this can build a steady base of patients, those patients may only be tied to you for as long as they have that vision plan, or for as long as you accept it.

If you don’t do enough to differentiate yourself as a practitioner and one or both of your vision insurance statuses change, that patient is not likely to return. Vision insurances think of the patients enrolled in their plans as their patients, a lot of patients will agree and look for strictly what's covered by their plan.

The biggest danger here is when a practice also considers vision plan patients as belonging to the plan, rather than being loyal to the office. If you believe that's the case in your practice, it's time for a change.

In-network & opt-out

As an independent eye care provider, you can choose how to work with vision insurance plans, if at all. You can be in network or out of network, that’s true, but there are other options within each.

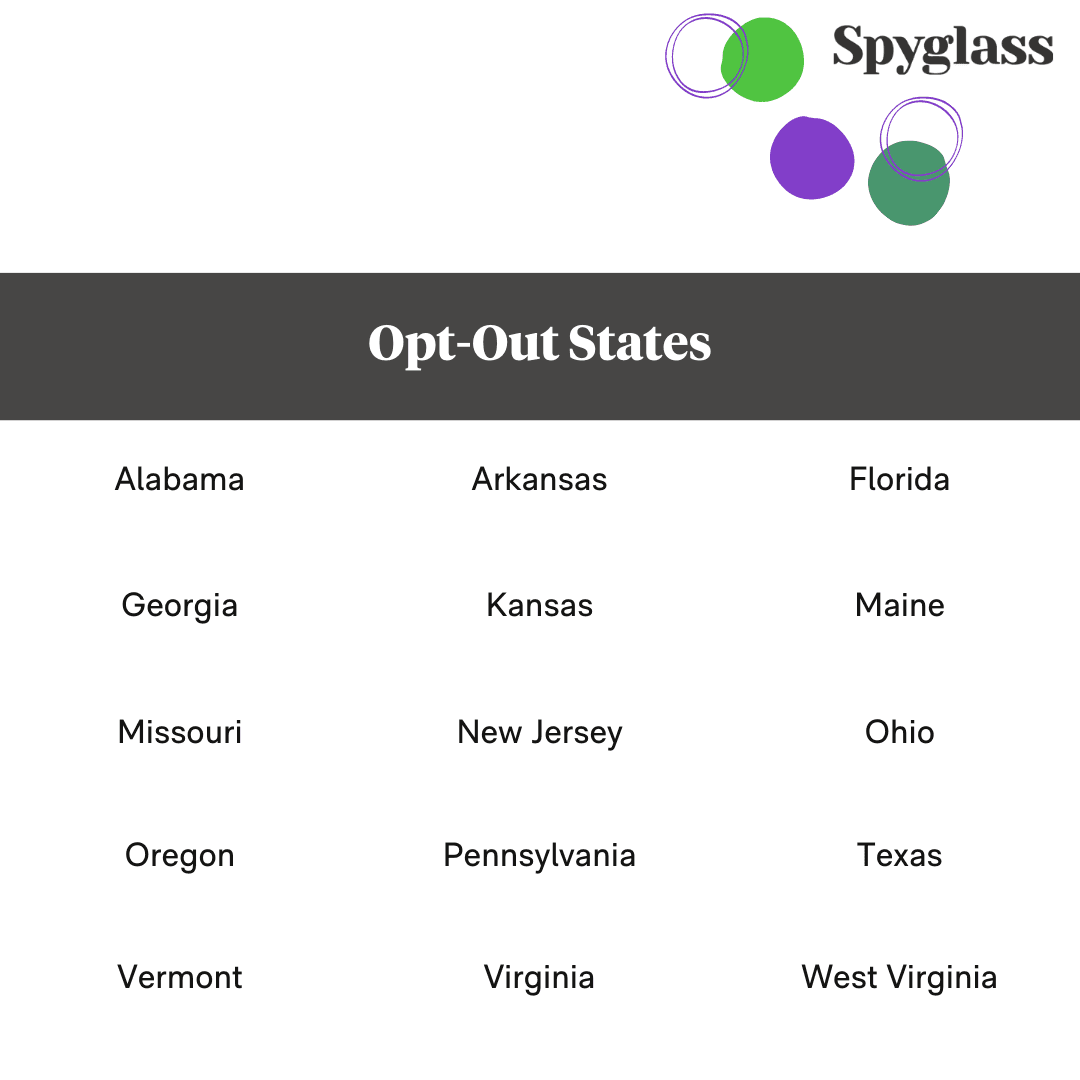

If you work in Arkansas, Georgia, Florida, Virginia, Missouri, Texas, Alabama, Vermont, West Virginia, Maine, Kansas, Oregon, New Jersey, Ohio, or Pennsylvania, and you choose to be in-network, you can elect to be an “Opt-Out” provider.

This allows you to use your own lab of choice and prescribe the best lenses for your patients all while being more profitable for your business. Once you decide to Opt-Out, you must inform (in writing) the vision plans with which you’d like to opt out, and set your other priorities in order.

When opted out, you will remain listed as an in-network provider on each vision insurance’s web portal, so you’re likely to continue seeing referrals from those networks.

Opting out does require a bit more work on your part: you have to work with the right lab partner, fit the right lenses, and train your staff appropriately to deliver the kind of service that you want your patients to receive, instead of what vision insurances dictate.

Out-of-network & Open Access

Your practice is considered out of network with a vision insurance when you’re not directly contracted with that vision plans, so you’re not obligated to perform anything in particular as dictated by the vision insurance company.

Many practices are in-network with some vision plans and out of network with others; sometimes their network status is a choice that the practice owner has made, and sometimes vision plan credentialing is limited by the plan itself.

Vision Service Plan (VSP) for example, won’t typically let a practice on their panel if the practice isn’t at least 50% owned by an optometrist, so optician and ophthalmologist owned practices are not generally allowed to be in network with VSP.

Eyemed will typically deny new practices enrollment into their panels if the geographic area is already saturated with Eyemed providers (sometimes that means too many independent practices, sometimes it means EssilorLuxottica owned locations like Lenscrafters, Pearle Vision, Target Optical, etc.).

There are, of course, exceptions to these rules: the biggest of which is when the practice is owned by a vision insurance company’s parent or sister organization. Restrictions and regulations come with every major vision plan in the space, so things like the above also apply to Versant Health, Davis Vision, Superior, Spectera, and so on.

If your practice is out of network with a given vision insurance plan, usually that means that the patient is on their own for reimbursement from their vision insurance. Practices may offer to print the receipt for the patient and some might even provide a CMS-1500 form for the patient to complete and mail in, but the uptake on that is incredibly low.

Open Access is what Anagram calls the service level for practices who are out of network with one or more vision insurance plans. Being Open Access allows you, the practice, to identify a patient’s out of network benefits and eligibility in seconds without ever having to sit on hold with a vision plan that may or may not give you adequate information to proceed.

As an Open Access provider, you’re also able to complete a digital CMS-1500 form on behalf of your patient, and Anagram will file that claim to the patient’s vision plan. Your patient receives a reimbursement check in around 2 weeks, while your practice has received 100% of the amount due at the time of sale.

No administrative tasks, no write-offs, nobody telling you which products to sell or which lab to send your work to; it’s pretty sweet!

Learn more about Being an Open Access provider.

Wrapping Up

While being in-network with a vision insurance can help attract new patients, increase revenue, and potentially build patient loyalty, it also comes with lower reimbursements, an administrative burden, limited treatment options, and limited control over pricing. If you are looking to attract new patients and build a steady base of patients, participating in some vision plans may make sense.

There are costs that come along with that, which we’ve hopefully made clear in this article. There are also other options for you to consider when deciding how to incorporate a more viable vision insurance plan strategy into your practice.

Ultimately, the decision you make as it relates to your practice’s participation in vision plans will depend on the goals and priorities you set for yourself and your business.